We live in a world where cash is king. So while you might believe that every dollar entering your business’ bank account is adding to your bottom line, this isn’t always the case. Negative dollars are flowing through your business and decreasing your net income.

So what exactly is a negative dollar?

Negative dollars are unfavorable changes in a dollar that hurt net income. They stem from expectations in the marketplace, and the top three sources originate from your own Profit & Loss statement.

What are the primary sources of negative dollars in a business?

While many factors cause negative dollars, there are three main scenarios where negative dollars arise:

1) Customers expecting annual price reductions

2) Suppliers and vendors expecting annual price increases

3) Employees expecting and deserving annual raises

These three situations are realities of doing business that won’t be going away anytime soon, especially with the state of the supply chain and labor market today.

So what can my business do about negative dollars?

The most important thing your business can do is to plan for annual negative dollar impact with great discernment. Negative dollar costs can be offset by driving multiples in revenue gains. However, in today’s market, new or incremental revenue cycles can last 8-12 months before top-line sales see a favorable impact. Not only that, but negative dollars can impact your business within a matter of days. This makes it all the more pertinent that your business plans for the influence negative dollars will have on your income statements.

What does that look like in numbers?

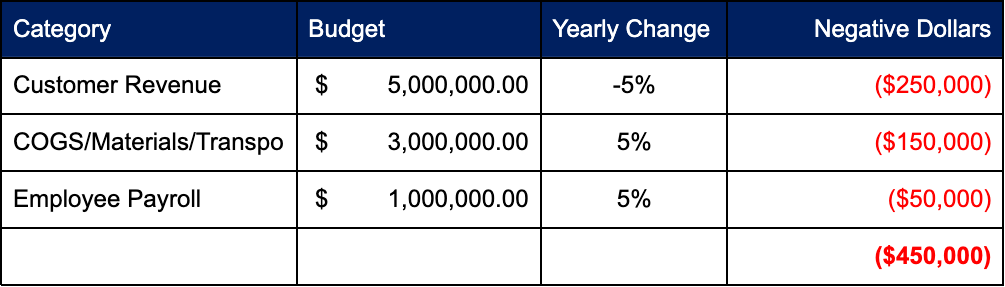

Assuming you start anytime in the year, obtain your company’s P&L and general ledger for the last trailing 12 months. Pull the 2-3 highest costs to the business (typically direct labor, COGS/materials, and transportation). Then, decrease revenue by 5% (attrition and price reductions) and increase all top costs by 5%. Eroding revenues and increased costs certainly stand out now, don’t they?

Example: Demonstrating a trifecta impact on Revenue, COGS and Payroll!

Company Name: Smooth Sailing, Inc.

This simple approach demonstrates that without even starting the year, Smooth Sailing could face a $450,000 P&L erosion before they even start a fiscal year.

Are there any easy answers?

Truthfully, no. If you refuse to give price reductions you risk losing revenues altogether. While creating value for your customers and delivering quality service can reduce price resistance, many will still expect decreases. Failure to give employees their due raises can result in losing your workforce and incurring all the costs associated with replacing them. Lastly, rejecting price increases from vendors is not likely to be successful without a highly strategic sourcing program.

So how can we be more disciplined when managing negative dollars?

By designing strong account management systems, your business can protect your revenues and increase your share of wallet from your current customers. Implementing strong sales management systems will drive new revenues from new customers. To eliminate wasteful activities that aren’t adding value to your customers, design and implement efficiency programs within your organization. Lastly, by designing and implementing a strategic sourcing program you can leverage your purchasing power in top categories. An annual RFQ process can keep the market honest and keep your costs down. Be sure to use vendor scorecards to monitor your suppliers’ performance.

Does your business have any programs in place to meet these expectations year after year while maintaining healthy accretive profitability?

Contact us today to set up a consultation where we can work together to navigate the challenges that come with negative dollars.